Radical Revolution Within The Retail Sector

The retail landscape is changing drastically. Do you remember the video store? Only 250 video stores remained In the Benelux in 2018. That is one-tenth of the total number of video stores in 2008. In February, the bankruptcy of Intertoys took The Netherlands by surprise, while in Belgium commotion arose concerning BNP Paribas Fortis’ announcement to close several branches. In 2018, there were 5133 bank branches in Belgium, which is a 38% decrease compared to 2008, but still 5 times more per capita than in the Netherlands.The food market seems to completely dodge this trend. In the Netherlands, the number of supermarkets grew by 3.2% to 6,000 in the period between 2008 and 2017. The total number of food stores increased by 1.5% to 19,000 during this period (Source: CBS).In Belgium, the number of self-service supermarkets decreased slightly (Source: Nielsen, F1, F2, HD, F3 superettes). However, we have seen an upward trend the past few years. The top 5 retailers continue to open new supermarkets. AH and Jumbo have an eye on Flanders and both expressed the ambition to reach the number of 100 stores.

The apparently innocent statement by Wouter Kolk: “I do not think we will have more than 1000 stores in the Netherlands in the future” (Source: Financieel Dagblad of 12 December 2018) – can be considered as a prelude of what is to come . Although many think that transformation will skip the food sector, we believe that all companies should prepare themselves for a future with far less physical stores.

The evolution of store functions.

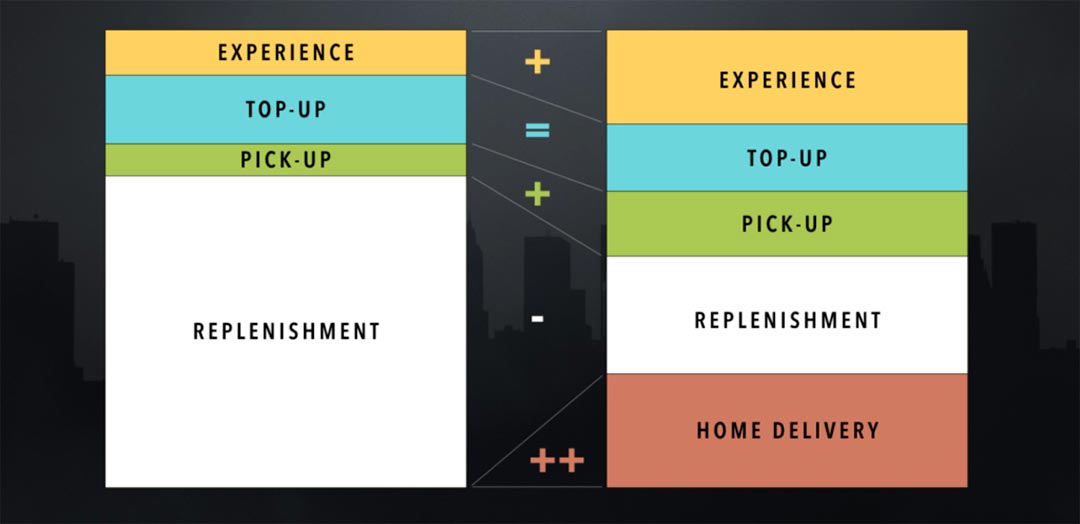

There is a broad consensus that the primary function of supermarkets and food retailers should evolve towards shopping experience. Supplementary shopping (so-called top-up purchases), such as fresh products or forgotten items, as well as impulse purchases, will certainly continue to play a role. Given the growing consumer demand for convenience, speed and efficiency, convenience shopping is bound to increase.

Retailers encourage grocery collection (pick-up shopping). It allows them to continue using their existing retail park, while collection costs are paid for by the consumer. A large proportion of consumers, mainly millennials, consider home-delivered groceries as the ultimate convenience (if they are delivered at a suitable moment). In addition, for millennials, free delivery services are self-evident. Retailers in fashion and in the non-food sector have set these practices as a standard for e-commerce. Even returns are free. No wonder that the consumer finds this normal.

Food retailers’ behavior in the Benelux ranges from denial to careful trying. But free home delivery is avoided at all costs. At present we estimate that the share of home delivery within food retail in the Benelux is less than 0.5%.

E-commerce in the food market is growing by more than 30% annually. Most estimates for 2025 range from 5 to 10%. Officially, food retailers do not believe in free home delivery and they expect this share to remain very small: “no demand, no profitable business model”.

But things might turn out differently.

The retail architecture of the future

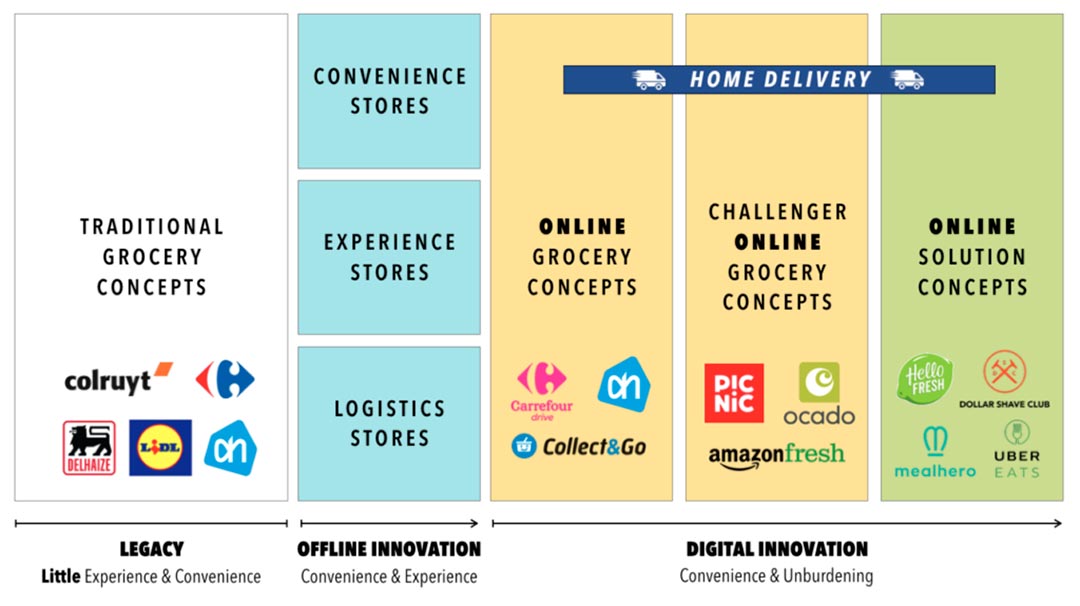

Broadly the changes are clear. Most existing stores offer little convenience and experience. A thorough transformation is needed. The physical store of the future will have to excel in terms of experience, location (so-called convenience stores) or pick-up convenience. A good combination of 2 or 3 of these features is of course also possible.

The online concepts of existing retailers all focus on pick-up. Although many experiments with home delivery have already been carried out, these are all put on the market with a hefty price tag. New players work massively with free home delivery. This model is closest to the expectations of the digital consumer. Of course they also have no stores, so no legacy business to defend.

The waves of disruption

The above architecture endangers the continued existence of many retail chains such as we know today. Retailers must ask themselves whether their existing stores are sufficiently adapted to the future needs and whether they are located in the right location. An adjustment of the retail park will require a considerable investment.

Profitability in retail is reasonably low. The net margin in the Benelux is around 3% on average. Colruyt and Ahold have the highest net margins, while other players have lower or even negative margins. An optimistic estimate shows that in Belgium 1 out of 10 supermarkets are loss-making, in the Netherlands this would be more in the lines of 1 in 15.

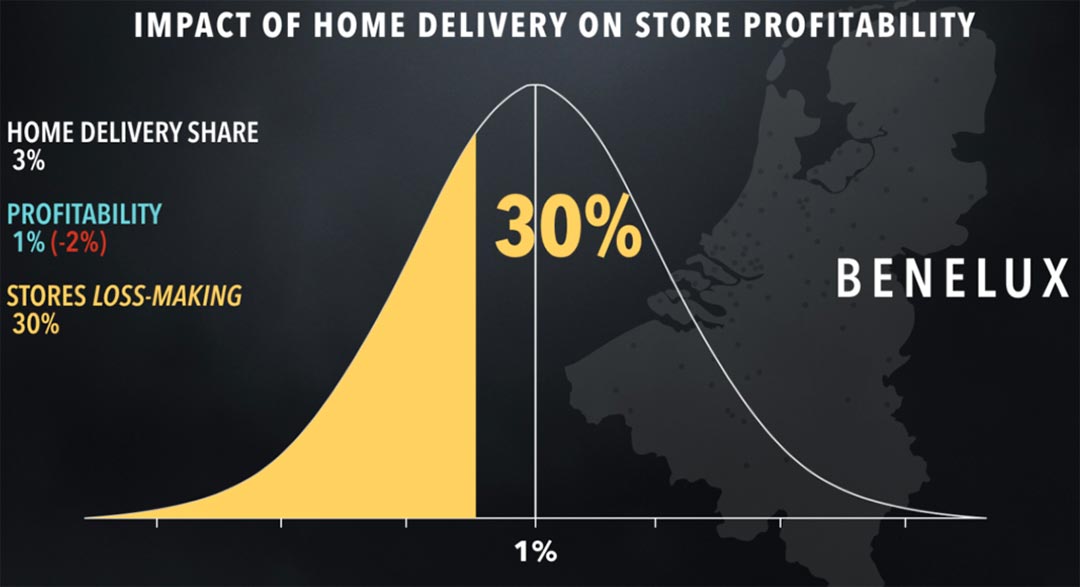

The shift towards home delivery is providing troubling times for the retail sector. This is due to the high fixed cost model of the sector. The fixed costs fluctuate between 60% and 70% of the turnover. So a small loss of, for example, 3% revenue to home delivery represents an average of 2% less underlying operating profit. The net margin in the sector would drop to 1% on average. This means that about 30% of the stores would become loss-making. Few retailers have the cash reserves to sustain this for a long time. The independent entrepreneurs (franchisees), who have a lotof stores at some chains, might then be even more inclined to throw in the towel.

The last man standing

Within the next 10 years we expect that 30 to 40% of the supermarkets will have to close due to a lack of profitability. We therefore have to ask ourselves why the big retailers still keep opening new stores. After all, they have sufficient insight into the market to be able to properly assess the above dynamics.

There are two main reasons: a tactical and a strategic one. From a tactical point of view, it is very difficult to close stores without losing sales and market share. The remaining stores in the neighborhood would immediately pick up that turnover. Most consumers do not shop more than 3 to 5 km from where they live or work. Strategically, the last remaining retailers will acquire a stronger market position. Indeed, a large proportion of consumers continue to shop physically. Consequently, the remaining stores would become extra profitable. “The last man standing wins”.

We are on the verge of a revolution in the retail sector, of which the ever-increasing changes will leave a lasting impact. The stakes are rising, the risks are getting bigger. Whoever will ultimately be the winner depends on the vision, flexibility and resilience of the players within the sector. “The only way to win is to learn faster than anyone else” as Eric Ries says.

About Nils van Dam

Nils is an experienced business leader with over more than 20 years of experience at CEO level in global, regional and local roles. He has a deep knowledge of the food and beverage industry and skills in general management, digital transformation, marketing and customer development.

What you can read next

De 3 lessen uit de neergang van Blokker België

De 3 lessen uit de neergang van Blokker BelgiëIntroductie tot de Blokker Case Op 18 februari 2020 kopt De Tijd “Blokker trekt zich terug uit België”. De eigenaar Michiel Witteveen zei: “De jongste 5 jaar stonden de omzet en de resultaten van de Blokker-winkels in...

Re-born Duval Union Consulting becomes Scopernia

Re-born Duval Union Consulting becomes Scopernia "A new style of consulting needs a suitable name." Ghent, 18 February 2020 – The management of Duval Union Consulting announces, on behalf of CEO Nils van Dam and founders Jo Caudron and Dado Van Peteghem, that the...

Why you should rescope your strategy

Why You Should Rescope Your Strategy Summary: a video for those who do not like to read why my new book resonates with many decision-makers the need to create strategy on a higher level: from just dealing with competition in the traditional way, over following digital...